On March 11, 2020, the World Health Organization declared COVID-19 a global pandemic. As the world stares down year three of a crisis that has affected so many lives and occupations, today, some of the biggest issues still revolve around the pandemic’s knock-on effects on businesses: acute bottleneck in supply chains, inflation, need for growth from establishments, increasing interest rates on loans, reduced cash liquidity for companies and individuals, selective credit from banks, the precondition to rebuild dismissed staff and lost markets in businesses, recapture morale for owners and employees, and more.

Growth is necessary for businesses and economies to survive and prosper, and the future of growth must be both sustainable and inclusive.

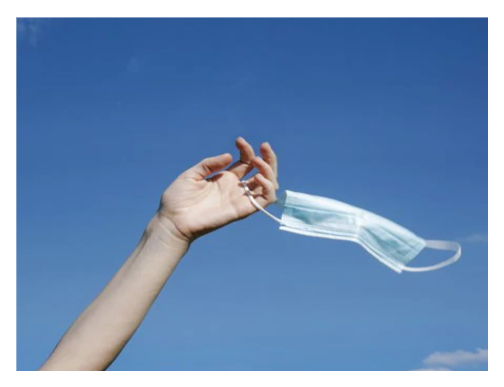

The Next Normal

Finding Solutions will require innovation and collaboration

At TCG Finance, we aim to help create positive, enduring post-Covid financing solutions for our clients. Credit at the most competitive terms and conditions, funding readily available and suitable, enhance clients cash liquidity. Moreover, diversification of lenders and solutions will allow a groundwork for the growth and recovery of the corporations that we serve.